VIX Term Structure: A Comprehensive Guide

Unlocking Market Volatility Expectations

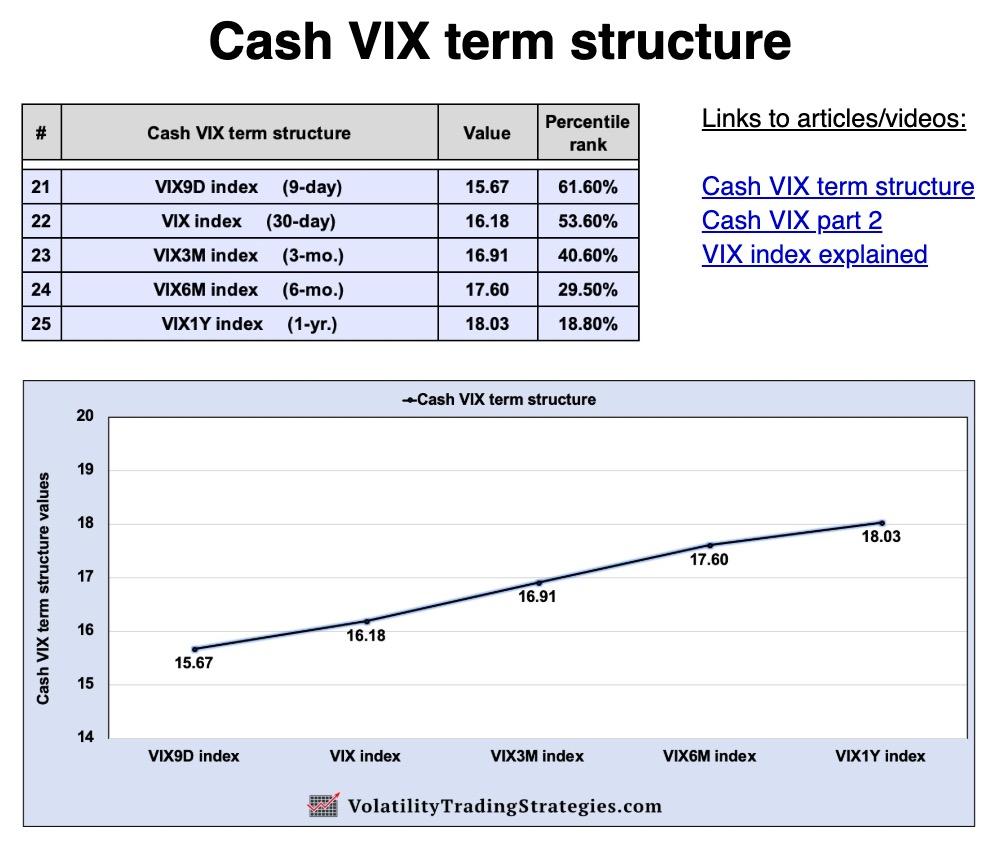

The VIX Index, often referred to as the "fear gauge," measures the implied volatility of the S&P 500 index. Its term structure, the relationship between VIX futures prices and their respective maturity dates, provides valuable insights into the market's expectations of future volatility.

Understanding the VIX Term Structure

The VIX term structure reflects the market's expectations of volatility at different points in time. By analyzing the contango (upward sloping) or backwardation (downward sloping) of the term structure, traders can gauge the market's outlook on future volatility.

A contangoed term structure suggests that the market expects volatility to increase in the future, while a backwardated term structure indicates expectations of decreasing volatility.

Trading the VIX Term Structure

Understanding the VIX term structure can provide opportunities for trading. Traders can enter into various strategies, such as calendar spreads or box spreads, to profit from the fluctuations in the term structure.

By combining instantaneous and long-term squared VIXs, traders can establish a parsimonious but effective model to forecast the volatility process.

Comments